Calculating Cost Basis For Cryptocurrency

Now we have been doing a little basic math here. How to calculate crypto taxes.

Fill Out Your Info To Learn More Click The Photo To See Our Website I Can Teach You How To Get Up To 3000 100 Legi Investing Afraid To Lose You Bitcoin

This seemingly simple formula becomes complicated when you add more transactions as we will see.

Calculating cost basis for cryptocurrency. However it gets a little trickier if you have multiple cost bases for a lot of crypto. The equation used to calculate gains and losses is very straightforward and we have been using it in the examples above. In that equation the 10000 represents the Fair Market Value the 8000 represents the gain and the 2000 represents your basis or cost.

Cost Basis refers to how much you paid to acquire the coins. At its core calculating crypto taxes is matching sales of crypto to their respective cost basis the price originally paid for that crypto and then calculating the gain or loss from this sale. If the gifted cryptocurrency is now less than the gifters basis then the giftees basis is the lesser of the gifters basis or the fair market value at the time of the gift.

How To Calculate Crypto Cost Basis. Your cost basis is technically in the quote currency that was used in the transaction. If you want to know the cash USDEURCAD cost basis of a trade that doesnt involve that currency youll have to estimate this yourself based on historical exchange rates.

Simple Cost Basis Formula. Fair Market Value - Cost Basis GainLoss Fair Market Value is the market price of the cryptocurrency at the time you dispose of it and Cost Basis is the amount it originally cost you to acquire the cryptocurrency. After much anticipation the IRS issued guidance on acceptable cost basis methods for calculating gainslosses on cryptocurrency.

In this video I cover the calculation of cost basis for US cryptocurrency holders for IRS tax purposes. This cost basis is used to calculate your gains and your losses. Doing the math then.

To calculate crypto cost basis there is a simple equation to follow. The reports you can generate on Coinbase calculate the cost basis for you inclusive of any Coinbase fees you paid for each transaction. For example according to CoinMarketCap historical data 1 BTC could be exchanged for between 6817 and 7135 on April 2 2018.

Cost basis purchase price exchange fees BTC holdings 3000 15x3000 1 3045 per BTC. I cover the inputs outputs limitations of TurboTa. 3000 selling price - 2800 purchase price or cost basis 200 capital gain.

If the cost basis cannot be determined then it is 0. Scivantage and Wolters Kluwer say that their software can handle transactions in multiple cryptocurrencies cryptocurrency forks and multiple methodologies for calculating cost-basis based on investor choice. The amount in USD that the cryptocurrency was worth at the time you bought it.

The cost basis is the amount that you spent to acquire an asset including the purchase price transaction fees brokerage commissions and any other relevant cost. Cryptocurrency is taxed as property not currency. Coinbase uses a FIFO first in first out method for your Cost Basis tax report.

Capital Gain Selling Price - Cost basis. As Binance does not offer USD trading pairs instead using Tether USDT you cannot immediately calculate the cost-basis for your purchases ie. It really is just about that simple.

Remember to include trading fees if any in the cost basis calculation. Purchase Price Fees Quantity. Prior to the IRS guidance there were numerous potential cost basis assignment methods taxpayers could choose from such as First in First Out FIFO Last in First Out LIFO Highest Cost Lowest Cost Average Cost and Specific Identification.

Capital Gain Selling Price - Cost basis. Realized Capital Gain Proceed Cost Basis Proceed refers to how much your coin was worth at the time of sale. This seemingly simple formula becomes complicated when you add more transactions as we will see.

Wolters Kluwer says it also has plans to track cost basis for cryptocurrency investments held in a private wallet. Using LIFO our cost basis or original purchase price of the 5 ETH that we sold off in June would be 2800 600 600 600 500 500. A capital gain profitloss occurs when you sell or trade cryptocurrencies and is calculated by subtracting the price you bought the crypto for cost-basis from the price you are selling it for.

Rather if the receiver has a gain then they take their gifters cost basis in the asset. Thus exchange calculations will have to be made to determine the basis in the newly acquired cryptocurrency. This cost-basis figure is.

For example in the US. 10000 2000 8000. A capital gain profitloss occurs when you sell or trade cryptocurrencies and is calculated by subtracting the price you bought the crypto for cost-basis from the price you are selling it for.

How Are Bitcoin And Other Crytpocurrencies Taxed Jean Galea

Whait Is Bitcoin Whatisbitcoinusedfor Bitcoin Mining Rigs What Is Bitcoin Mining Cryptocurrency

What Is The Difference Between Net Fiat Invested And Cost Basis Investing Fiat Money Fiat

Ireland Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Cryptocurrency Mining Calculators For Wordpress Bitcoin Mining Bitcoin Cryptocurrency Cryptocurrency

Cryptocurrency Taxation How To Take A Step Forward Inter American Center Of Tax Administrations

Coinmarketcap Api To Google Sheets Crypto Prices Google Sheets Tutorial Apipheny

Cryptocurrency Exchange Software Trading Benefits Bitcoin Cryptocurrency Script

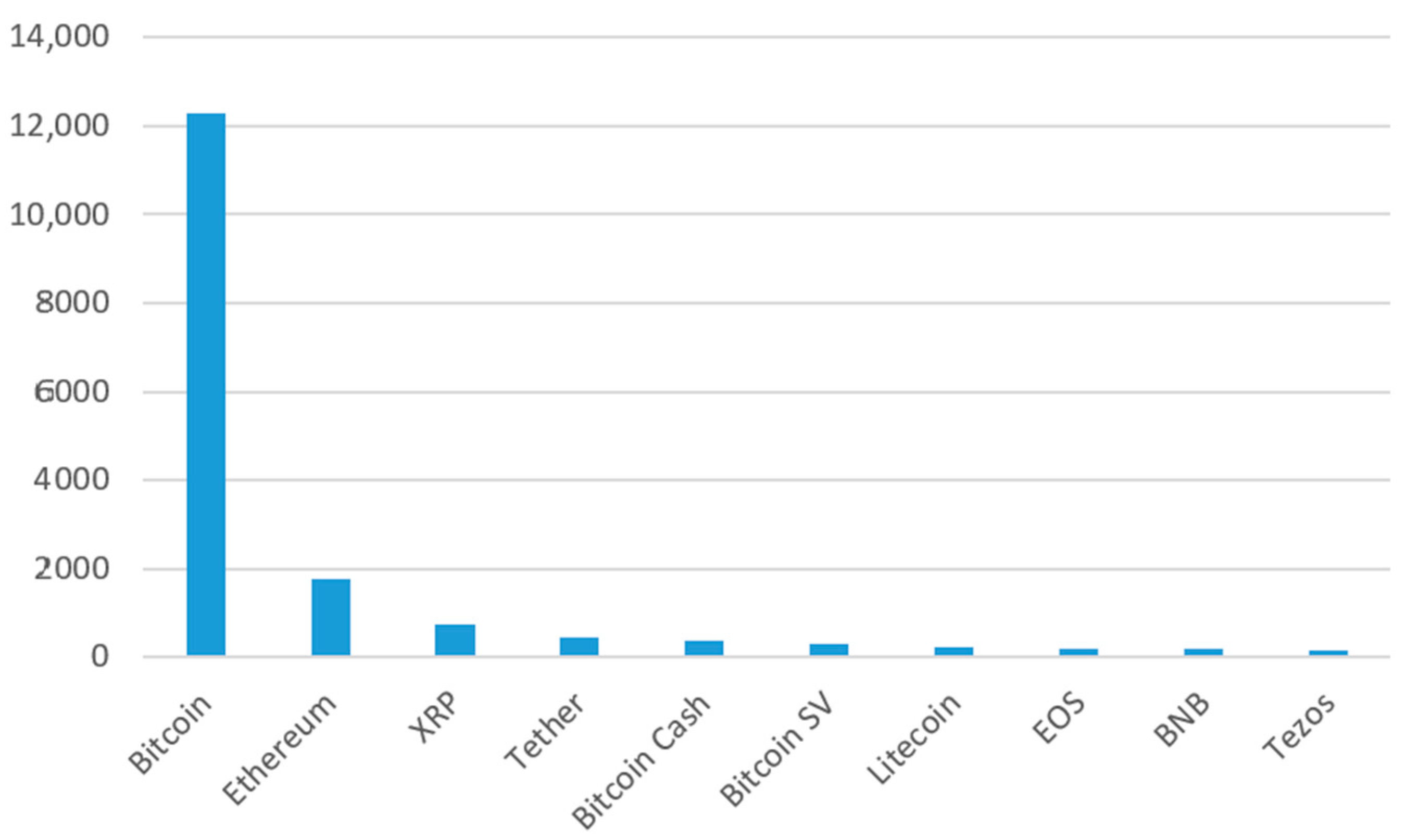

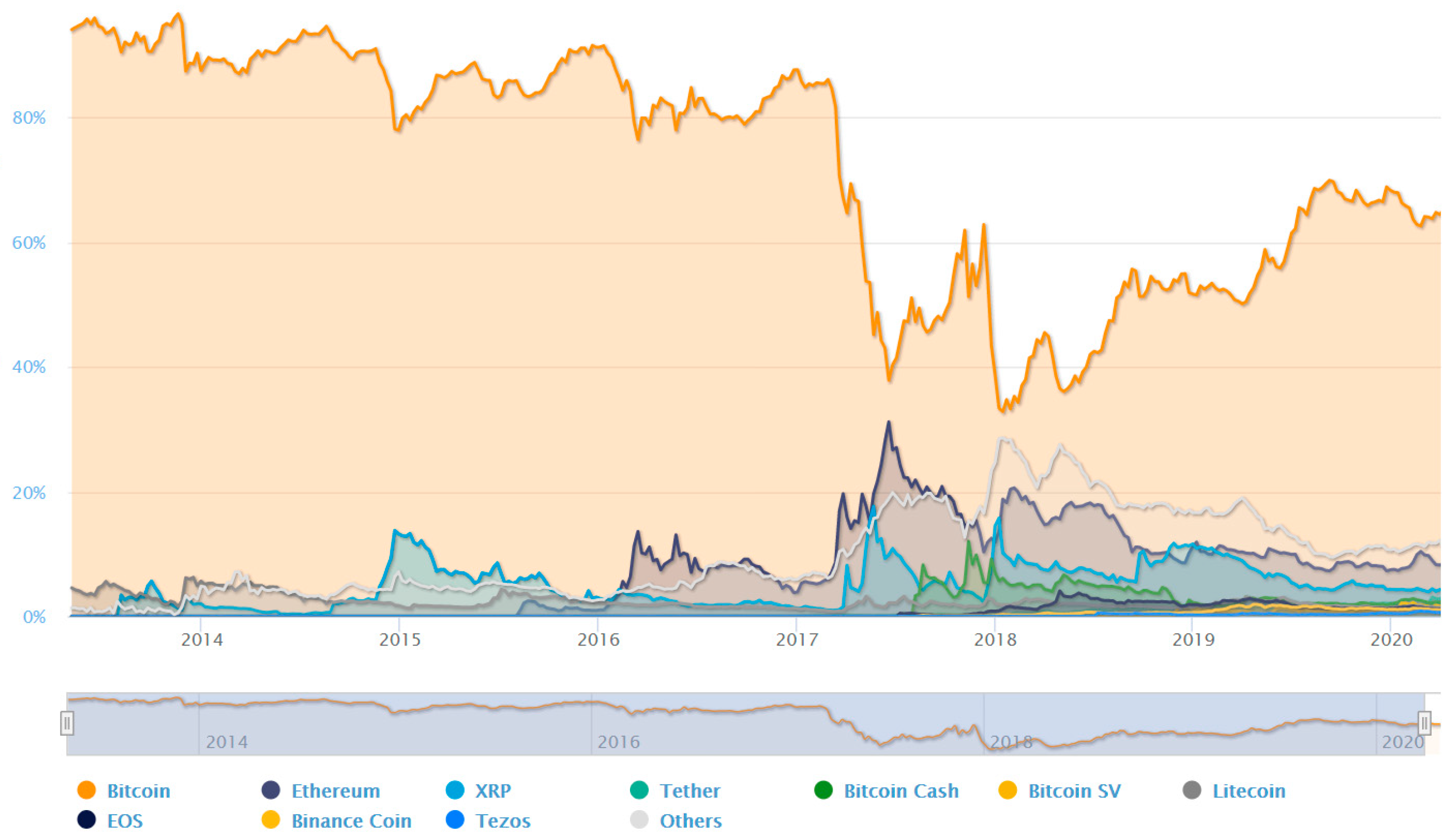

Joitmc Free Full Text Cryptocurrency Market Analysis From The Open Innovation Perspective Html

Pdf How To Measure The Liquidity Of Cryptocurrency Markets

Top 8 Instagram Accounts To Follow For Cryptocurrency Trading Cryptocurrency Trading Instagram Accounts To Follow Best Crypto

Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

Joitmc Free Full Text Cryptocurrency Market Analysis From The Open Innovation Perspective Html

How To Use The Coinmarketcap Portfolio Coinmarketcap

A Complete Guide To Bitcoin Etfs What You Need To Know In 2020 Bit Sites Cryptocurrency Bitcoin Investing In Cryptocurrency

Cryptomania Cryptocurrency Trading Board Game Cryptocurrency Trading Cryptocurrency Buy Cryptocurrency

/dotdash_Final_Why_Do_Bitcoins_Have_Value_Apr_2020-01-0a8036d672c34d69bd2f4f5175b754bb.jpg)