Accounting Cpe Cryptocurrency

If the value of that currency rises gains are not logged until time of sale. Level Basic Intermediate Advanced.

For example depending on the nature of the underlying asset you might account for.

Accounting cpe cryptocurrency. Cryptocurrency is accounted for as an intangible asset. Securities regulators have raised con-. This two-part webinar will teach you what blockchain is and what you can do with it as well as the taxation of the most popular use cases of cryptocurrency ie how to treat the tax returns of your clients who are active in the cryptocurrency market.

Yet the adoption of crypto is becoming more common. In the absence of formal guidance accounting for tok ens is based on the rights and obligations attached to them. As trusted advisors CPAs can assist in providing effective measures to avoid cryptocurrency scams.

Companies which impair cryptocurrency for accounting purposes need to evaluate their sources of income to see if they have any capital gains income when evaluating the need for a valuation allowance on the deferred tax asset DTA. Instead theyre issued by the private sector and designed to go completely around the existing monetary system. Cryptocurrency oferings such as initial coin oferings and initial token ofer ings are gaining traction in the global fnancial markets with over US5 billion raised to date as of December 31 2017.

So while a company may mark down to fair value for accounting purposes tax does not follow that methodology. In the event that value is lost however that loss is recorded as an impairment charge. Blockchain and cryptocurrencies such as Bitcoin and Ethereum are two of the hottest technology topics today.

Learn about market capitalization of crypto assets crypto asset exchanges and how to. CPE Field of Study. A discussion of possible approaches to accounting for cryptocurrencies under existing IFRS.

A brief summary of the tax implications of transactions involving cryptocurrencies. Kirk is a cryptocurrency blockchain and ICO advisor investor and evangelist who weaves risk management into business processes. Accounting for Cryptocurrency Speakers.

2 CPE Credits. This webinar will prepare accountants with the basic questions that should be asked when a client affirms ownership of cryptocurrency and a basic understanding of the risk a. Although cryptocurrency is property it is not real property and therefore is not eligible for Section 1031 treatment.

An Accountants Guide to Cryptocurrency and Blockchain. Jennifer Dymond Course Description Coming Soon. The main reason is that theyre not an established currency thats recognized by a government.

IFRIC s proposals deal only with cryptocurrencies. An update on accounting standard-setting activity related to cryptocurrencies. Yet few business professionals understand these technologies their capabilities their risks and their potential impacts on business operations and processes such as contract.

Return to all sessions. Reuters reports that companies record the value of virtual currency at the time of purchase. It utilizes computerized encoding and decoding technology to secure and verify transactions and control the creation of new units.

Be at the forefront of shaping the adoption of blockchain in accounting and finance The new Blockchain Fundamentals for Accounting and Finance Professionals Certificate offers you the opportunity to build a foundation toward becoming a strategic business partner within your organization and with your clients. The IRS requires reporting any transaction involving cryptocurrency as a sale or exchange of property with the taxpayer bearing responsibility for calculating and maintaining basis in their virtual currency holdings. This webcast analyzes how cryptocurrencies are used to perpetrate cyber-fraud and traditional fraud schemes.

As a speaker and continuing education crypto lecturer for CPAs and attorneys hes a recognized thought leader on crypto security strategy accounting and taxation. The short answer for the appropriate accounting is to treat cryptocurrencies as an intangible asset. As cyber-crime continues to expand CPAs and Forensic Accountants need to gain knowledge of the current trends facing the public.

Digital assets are a new frontier. There is no playbook and relatively few rules to guide the way. A brief overview explaining what cryptocurrencies are.

4 An Introduction to Accounting for Cryptocurrencies. Explain cryptocurrencies and the technologies behind them. 1 Overview CPE credit Taxes Cryptocurrencies have been in the spotlight recently prompting many management teams and boards to explore how to integrate digital assets into their business.

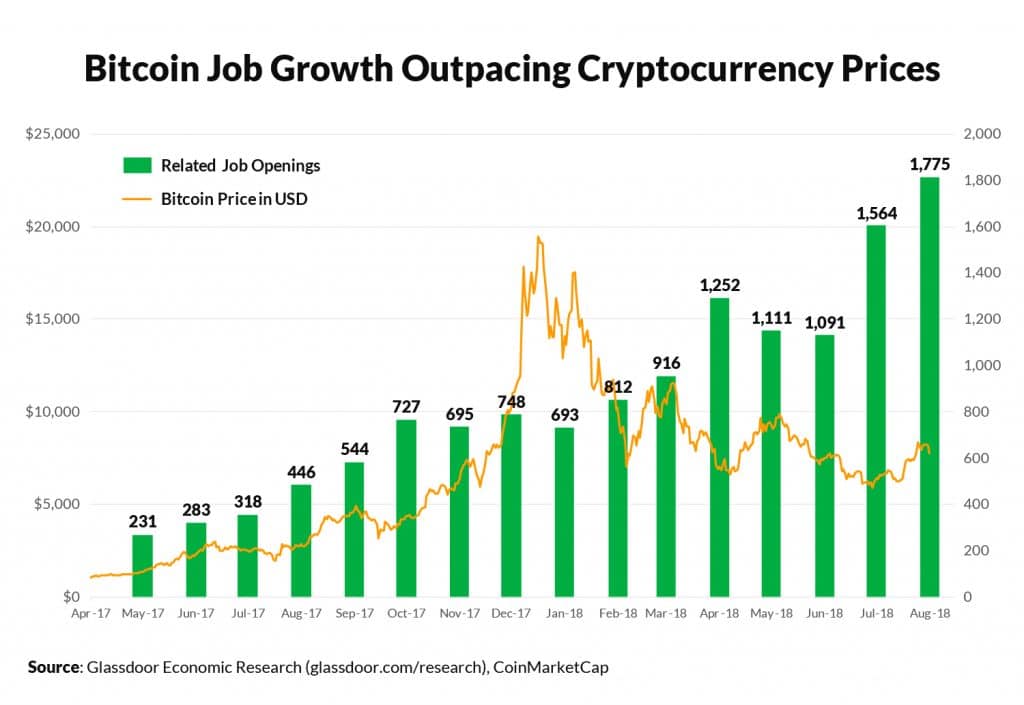

With the growing popularity of the crypto market accountants with a strong knowledge of cryptocurrency and blockchain technology are already increasingly in demand as an intricate understanding of the technology and accounting standards is required to provide appropriate guidance. Cryptocurrency is a digital or virtual currency designed to function as a medium of exchange. There is cur rently no specific accounting guidance on other cryptoassets such as tokens.

This CPE self-study course will help you gain knowledge about the various ways of securing digital assets including multisig wallets two-factor authentication and password manager.

Arbittmax Cryptocurrency Accounting Gaap

![]()

2021 What Cpas Should Know About Cryptocurrency

Cryptocurrency Tax Reporting Webinar Series Part 1 Webinar Cpa Com

Irs Makes Major Change To Cryptocurrency Taxation

The Classification Of Bitcoin And Cryptocurrency By The Irs Cpa Practice Advisor

Blockchain Bitcoin Why The Accounting Profession Should Take Notice Cpa Practice Advisor

Bitcoin And Cryptocurrency In 2021 Blockchain Cryptocurrency Blockchain Technology

Thinking Of Hiring A Crypto Cpa Read This First

Study Illicit Exfiltration And Cryptocurrency To Prevent Fraud

2021 What Cpas Should Know About Cryptocurrency

Cryptocurrency Tax Reporting Webinar Series Part 1 Webinar Cpa Com

2021 What Cpas Should Know About Cryptocurrency

Arbittmax Cryptocurrency Accounting Gaap

Cpa Academy Intro To Cryptocurrency And Taxes

Bitcoin And Cryptoassets An Accountant S Guide Online Cpa Cpe Course